Smart Budget Surplus Strategies

When your business generates more cash than planned, what happens next matters enormously. We've helped Korean companies and international firms operating here make better decisions with surplus funds since 2020.

Discuss Your Situation

Beyond Basic Savings Accounts

Most businesses park surplus funds in low-yield accounts and call it conservative. But there's a middle ground between risky speculation and earning nearly nothing.

Market Context Analysis

We examine your industry cycles, seasonal patterns, and competitive landscape. A surplus in Q2 might need different treatment than unexpected year-end profits. Context drives every recommendation we make.

Risk Tolerance Mapping

Your comfort level with various investment vehicles matters more than theoretical optimal returns. We start with detailed conversations about what keeps you up at night and what doesn't.

Regulatory Compliance

Korean financial regulations affect how businesses can deploy surplus funds. We navigate these requirements while maximizing your available options within legal frameworks.

Liquidity Planning

Some surplus money needs to stay accessible for unexpected opportunities or challenges. We help determine the right balance between growth potential and quick access to funds.

How We Work Together

Our process focuses on understanding your specific situation before suggesting any financial moves

Current Position Assessment

We analyze your cash flow patterns, upcoming capital needs, and existing financial commitments. This isn't just about the surplus amount - it's about understanding how this money fits into your broader business strategy.

Opportunity Identification

Based on your risk profile and business goals, we identify potential deployment strategies. This might include growth investments, debt reduction, or diversified financial instruments that align with your timeline.

Implementation Support

We help coordinate with your existing accountants, lawyers, and financial institutions to execute chosen strategies efficiently. Our role is advisory - you maintain complete control over all decisions and relationships.

Ongoing Monitoring

Market conditions and business needs change constantly. We provide quarterly reviews to assess performance and suggest adjustments when circumstances warrant different approaches.

Why Experience Matters

Budget surplus management isn't just about picking investment products. It requires understanding business cycles, Korean market dynamics, and the specific challenges of your industry.

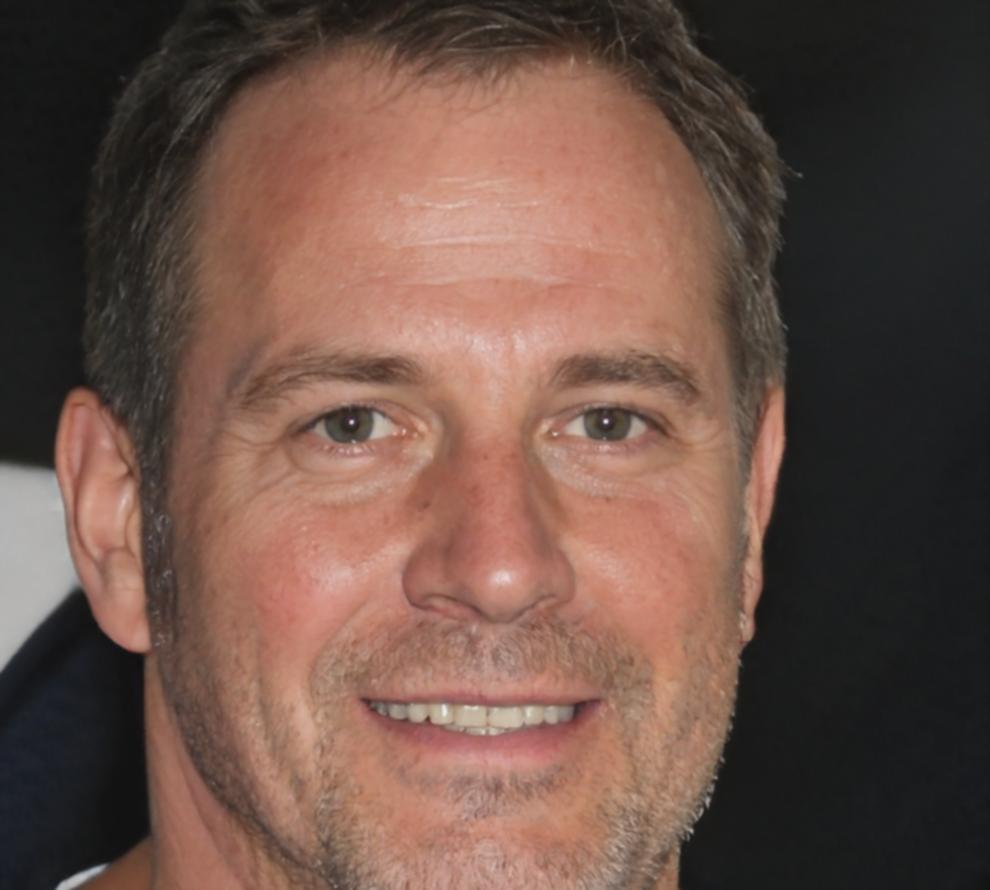

Kyung-min Park

Senior Financial Strategist

-

Local Market Knowledge

We understand Korean banking relationships, regulatory requirements, and cultural expectations around business financial management. This local expertise prevents costly mistakes.

-

International Perspective

Many of our clients operate across borders or work with international partners. We help navigate currency considerations and cross-border investment implications.

-

Industry-Specific Insights

Manufacturing companies have different surplus patterns than service businesses. We've worked across various sectors and understand these nuances matter for strategy selection.

Ready to discuss your surplus funds?

Schedule a confidential consultation to explore how your excess budget can work harder for your business. We'll review your situation and suggest practical next steps.

View Upcoming Sessions